ICBC wins interim approval for 6.3 percent hike to basic insurance rates

For the second time since the NDP took power in B.C. in 2017, basic vehicle insurance rates will rise more than six percent.

Today, the B.C. Utilities Commission gave the green light—on an interim basis—to ICBC's application for a 6.3 percent hike, effective April 1.

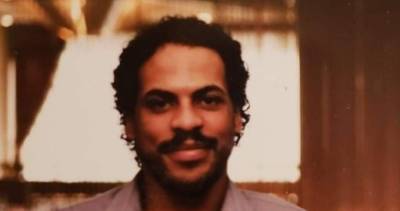

In 2017, the minister responsible for ICBC, David Eby, announced a 6.4 percent boost in basic auto insurance rates.

That was significantly lower than a 20 percent increase recommended in a report.

The latest price hike is designed to preserve ICBC's insurance capital while its application is being reviewed.

Interveners can register until January 21 to make submissions to the BCUC.

"At the end of the regulatory process, the BCUC will reach a final decision on ICBC's basic rate application for policy year 2019," ICBC said in a news release. "The BCUC will determine how any difference between the approved interim rate and permanent rate will be refunded or collected at the time of its final decision."

ICBC hasn't disclosed how much optional insurance will go up this year.

The latest increase comes at a time when the public auto insurer is under severe financial stress.

ICBC lost $913 million in 2016–17, followed by a $1.3-billion loss in 2017–18. It's forecasting an $890 million loss in the current fiscal year, which ends on March 31.

Nearly a year ago when the magnitude of the financial problems were made public, Eby referred to the situation as a "financial Dumpster fire" left by the former B.C. Liberal government.

Eby has refused to entertain B.C. Green Leader Andrew Weaver's call to consider no-fault ICBC insurance to drive down costs.

Eby has, however, capped awards at $5,500 for pain and suffering for minor injuries. Those motorists who want a higher cap will have to pay significantly higher insurance rates.

In addition, the government has created a tribunal to address some injury claims.

When these changes were announced, ICBC said it would double the medical care and recovery cost allowance to $300,000, effective April 1, for people who are "catastrophically injured".

Wage-loss payments have been doubled to $740 per week, funeral cost coverage has been tripled to $7,500, the death benefit has been hiked to $30,000, and home-support benefits have been almost doubled to $280 per week.

More

Comments